The 2-Minute Rule for G. Halsey Wickser, Loan Agent

Table of ContentsSome Ideas on G. Halsey Wickser, Loan Agent You Should KnowSome Of G. Halsey Wickser, Loan AgentGetting The G. Halsey Wickser, Loan Agent To WorkLittle Known Facts About G. Halsey Wickser, Loan Agent.The Buzz on G. Halsey Wickser, Loan Agent

When functioning with a home loan broker, you should clarify what their fee structure is early on in the process so there are no surprises on shutting day. A home mortgage broker normally only obtains paid when a financing closes and the funds are launched.Most of brokers don't cost customers anything up front and they are typically safe. You need to utilize a home loan broker if you wish to discover access to home loans that aren't readily advertised to you. If you don't have incredible credit scores, if you have a special loaning situation like owning your very own business, or if you just aren't seeing mortgages that will benefit you, after that a broker may be able to obtain you accessibility to lendings that will be valuable to you.

Mortgage brokers might also be able to help finance candidates get approved for a reduced rates of interest than the majority of the industrial lendings offer. Do you require a home loan broker? Well, working with one can conserve a borrower effort and time throughout the application process, and possibly a lot of cash over the life of the finance.

G. Halsey Wickser, Loan Agent Things To Know Before You Buy

A specialist home mortgage broker originates, works out, and refines property and business home loan in behalf of the customer. Below is a six point overview to the services you need to be provided and the expectations you ought to have of a qualified home mortgage broker: A mortgage broker supplies a variety of mortgage from a variety of different lenders.

A home mortgage broker represents your passions as opposed to the interests of a loan provider. They ought to act not only as your representative, yet as a well-informed specialist and issue solver - mortgage lenders in california. With accessibility to a variety of home loan items, a broker is able to supply you the best value in terms of rate of interest, payment amounts, and financing products

Several situations require more than the basic usage of a thirty years, 15 year, or flexible rate home mortgage (ARM), so cutting-edge mortgage strategies and sophisticated solutions are the advantage of dealing with a skilled home mortgage broker. A home loan broker browses the client with any kind of situation, taking care of the procedure and smoothing any type of bumps in the road in the process.

G. Halsey Wickser, Loan Agent - Questions

Customers that locate they need larger car loans than their bank will certainly accept additionally take advantage of a broker's expertise and capability to effectively obtain funding. With a home mortgage broker, you just need one application, instead than completing types for each and every private lending institution. Your home mortgage broker can supply a formal contrast of any financings advised, directing you to the info that precisely portrays cost differences, with present rates, factors, and closing expenses for each and every loan mirrored.

A trusted home loan broker will certainly reveal just how they are spent for their solutions, in addition to detail the total expenses for the lending. Personalized service is the separating variable when selecting a mortgage broker. You ought to expect your home loan broker to help smooth the way, be available to you, and suggest you throughout the closing process.

The trip from dreaming regarding a brand-new home to in fact having one might be filled up with obstacles for you, particularly when it (https://creator.wonderhowto.com/halseyloanagt/) comes to safeguarding a home loan in Dubai. If you have actually been thinking that going straight to your financial institution is the most effective route, you may be missing out on a less complicated and possibly extra advantageous alternative: collaborating with a home loans broker.

4 Simple Techniques For G. Halsey Wickser, Loan Agent

Among the substantial benefits of making use of a mortgage specialist is the professional economic guidance and essential insurance coverage assistance you receive. Mortgage experts have a deep understanding of the various monetary products and can assist you select the ideal mortgage insurance policy. They guarantee that you are effectively covered and give suggestions customized to your economic circumstance and lasting objectives.

This procedure can be complicated and lengthy for you. A home mortgage brokers take this worry off your shoulders by handling all the documents and application processes. They recognize specifically what is called for and make certain that every little thing is completed accurately and promptly, reducing the risk of hold-ups and mistakes. Time is money, and a mortgage financing broker can conserve you both.

This implies you have a much better opportunity of discovering a home loan in the UAE that flawlessly suits your requirements, consisting of specialized products that could not be offered via standard financial networks. Navigating the mortgage market can be confusing, especially with the myriad of products readily available. A supplies expert assistance, aiding you understand the pros and cons of each alternative.

The G. Halsey Wickser, Loan Agent Statements

This specialist suggestions is invaluable in protecting a home loan that aligns with your economic goals. Home loan experts have developed partnerships with several loan providers, giving them significant discussing power.

Scott Baio Then & Now!

Scott Baio Then & Now! Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Charlie Korsmo Then & Now!

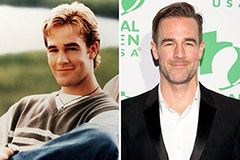

Charlie Korsmo Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!